Social media is part of daily life. Millions of people post every day, even more scroll through their feeds, and the media relishes reporting on the social media activity of celebrities and influencers. But did you know that insurance companies may be scrolling through social media to find evidence to use against you in a car accident claim? It’s crucial that you’re aware of what posting on social media after a car accident can do to your case.

Social Media Can Be Used Against You in a Car Accident Claim

Let’s take the example of Neveah. Neveah suffered lower back injuries after a car accident caused by a negligent truck driver. She underwent surgery and months of physical therapy in order to recover but hasn’t been quite the same since the accident. The insurance company devalues or denies Neveah’s claim, saying she wasn’t really injured. The proof? An Instagram post on Neveah’s account showing her at the beach next to friends playing volleyball with a caption of “Hours of fun, never felt better!”.

It doesn’t matter that Neveah didn’t play volleyball for hours and that just the outing alone forced her back to physical therapy. The defendant's lawyers and insurance companies can bring doubt into your claim and refuse your compensation demands through evidence they find on social media.

Tips for Using Social Media after a Car Accident

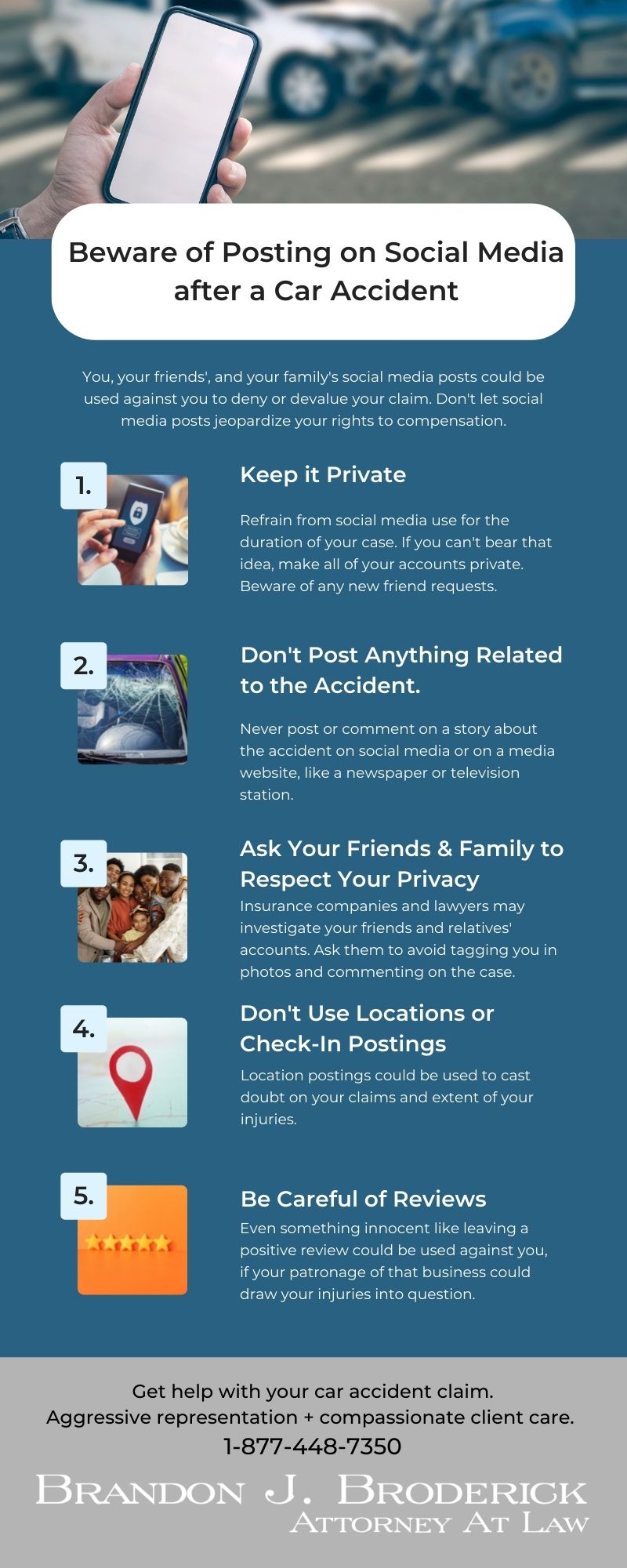

The best advice for using social media after a car accident is not to. If you can’t bear the idea of refraining from social media use for the duration of your claim, you should at least make all of your accounts private. In addition, follow these guidelines:

Don’t Post Anything Related to the Accident. Do not post anything related to the accident and ensure your friends and relatives do the same.

Do Not Comment. Never comment on a story in the media about your case or accident. Remember that comments on other people’s posts may be public.

Beware of Reviews. Even something like leaving a positive review could be used against you, if your patronage of that business could draw your injuries into question.

Ask Your Friends to Avoid Tagging You. Its not just your social media accounts an insurance company or defendant's lawyer can review, it’s anyone related or close to you also. Make sure your friends and family don’t tag you, especially in any photos that could draw the level of severity of your injuries into question.

Don’t Use Check-Ins. “Check-ins” and location postings may seem innocent but because they allow others to see exactly where you are, they could be used to try to cast doubt on your claims. Avoid “check-in” posts on social media throughout the course of your injury case.

Remember, anything you post or others post about you on the Internet is considered public record. Don’t let the insurance companies compromise your claim by using social media posts as evidence against you.

Get Help You With Your Car Accident Settlement

Once you accept a settlement offer, you cannot go back and reopen your claim. You should never accept an offer without discussing your case with an experienced car accident lawyer. An attorney will help you understand the unique factors in your case, build your case and work to maximize the compensation amount for your losses. If the insurance company is denying or devaluing your claim, contact our top rated car accident attorneys for a free legal review of your case.

When you hire a New Jersey car accident lawyer from our team at Brandon J. Broderick, you pay nothing upfront. We work on contingent fees that are only collected if we win your case. If we don’t win, you don’t pay.

Without a legal claim, the insurance company can offer you a lowball offer that barely covers any of your needs and may even refuse to cover some of the damages. You may be left having to pay for the costs of your injuries on your own. Contact us today and let us turn your setback into a comeback.